Nominal nonsense

I'm not the crazy one

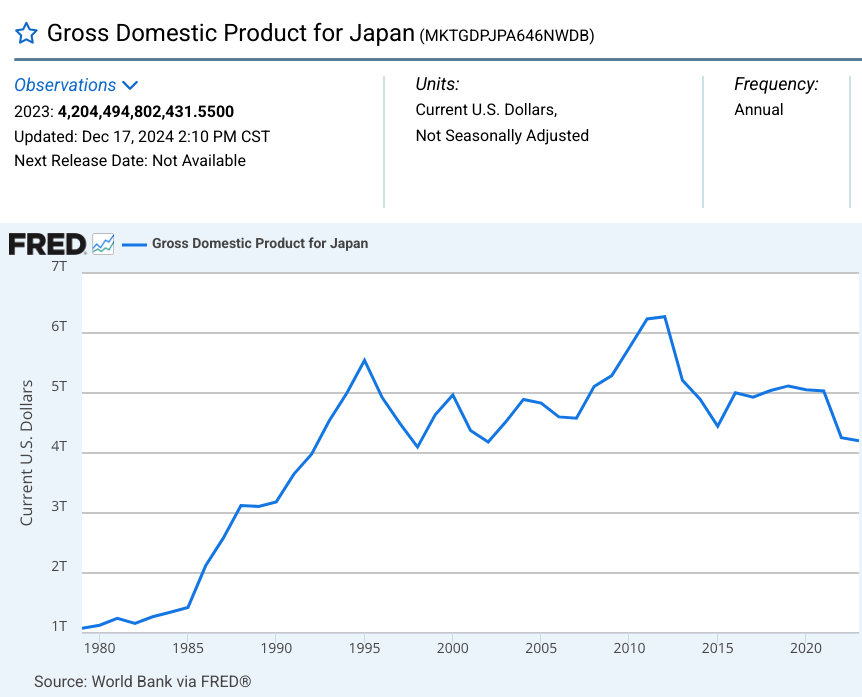

I frequently need to pull up international data for variables such as nominal GDP, particularly when writing blog posts. One of my pet peeves is that when I ask for the nominal GDP for a foreign country, they often give me the data in US dollars. For instance, here’s a data series that you can find in the famous FRED data site:

In fairness, FRED also provides the “correct” data series, the one measured in yen terms. But an unsuspecting reader might not notice the phrase “Units: Current U.S. Dollars” provided in small print right above the graph. For some countries, it’s hard to find anything other than NGDP measured in US dollars.

In US dollars terms, Japan’s nominal GDP has fallen by a third since 2012, from almost $6.3 trillion to about $4.2 trillion. I won’t say that this data is completely meaningless, but it’s a bit misleading to call this data series “Japanese nominal GDP”. Why not measure it in terms of euros, or Zimbabwe dollars?

Many people think of nominal GDP as “the economy”, and NGDP targeting as steering the economy. It is nothing of the sort. Real GDP is a better description of what people mean by “the economy”. Indeed, when the news media says “the economy” grew by 2.4% in a quarter, then mean real GDP increased at a 2.4% annual rate. Nominal GDP is ignored.

When I try to explain market monetarism to people, especially the role of NGDP, I find that it can be helpful to do some unusual thought experiments. I try to get people thinking about NGDP not as “the economy”, but rather as “an indicator of the value of money”. It’s obvious that if Zimbabwe’s NGDP rises by a billion-fold, that fact is telling us more about the Zimbabwe dollar than about Zimbabwe’s real economy. But this is not only true in cases of hyperinflation.

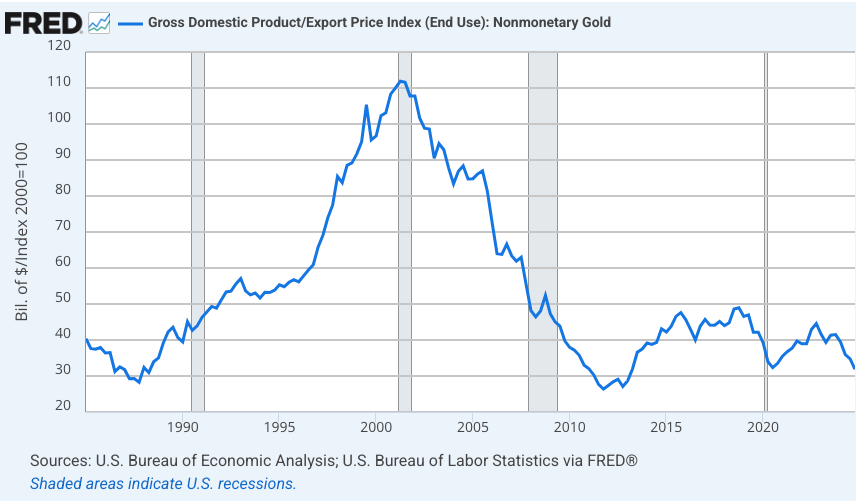

Here’s the US nominal GDP measured in terms of units of gold:

Between 2002 and 2012, our nominal GDP in gold terms fell by more than 70%, even more than during the Great Depression. But very few people regard that fact as being particularly meaningful. Because labor contracts and goods prices in America are generally quoted in US dollars, any measure of nominal GDP using an alternative unit of account will be of little interest to most people. America’s NGDP in US dollar terms is uniquely important because the dollar is our unit of account. (This is also why base money is uniquely important, it is America’s medium of account.)

[As an aside, if you are wondering why America’s NGDP in gold terms has fallen so much during the 2000s, it’s because of surging gold demand in two countries, India and China. They now consume more than 50% of global gold production, whereas the US consumes less than 6%. Surging gold demand during the 2000s raised the real price of gold (relative to other commodities) and sharply reduced America’s nominal GDP in gold terms.]

OK, I hope I’ve convinced you that the most useful measure of nominal GDP is in the currency of the local economy. After all, to the extent that NGDP matters at all, it’s because fluctuations in NGDP combined with sticky nominal contracts (and unindexed tax systems) create real distortions in the economy. For other purposes such as measuring living standards, real GDP is more useful. Because NGDP matters only because of nominal stickiness, you should never measure the size of an economy in anything other than one of the following two choices:

Real terms

Local currency nominal terms

Some of you might think “Sumner’s that weird economist who’s always doing odd thought experiments like US GDP in gold terms of Japan’s GDP in US dollar terms. He’s an oddball.” In fact, just the opposite is true. It’s the rest of the world that’s crazy, I’m one of the few sane people. Google “world’s second largest economy” and you’ll see a long list of people claiming the honor belongs to China. But that’s only true if you measure GDP in dollar terms using market exchange rates. And that’s exactly what we did in the Japanese GDP graph above, which I hope we all agree is completely nuts.

To be clear, I’m not saying that the strong US dollar doesn’t matter at all, or that GDP perfectly measures living standards. Today, Japanese and Chinese tourists visiting America suffer a loss of purchasing power due to the strong dollar, and this marginally affects living standards in those two countries, an effect not picked up in GDP data. But it’s absurd to measure a restaurant meal in a little village in central China in US dollar terms. What would be the point?

It is especially silly to measure China’s GDP in dollar terms if you are interested in things like great power competition. China buys most inputs for its military at far lower prices than the US spends on its inputs. (Conversely, the US leads in many high-tech areas.)

You can think of Google search and “AI Overview” as measuring something close to conventional wisdom. If the conventional wisdom is that China has the world’s second largest economy (whereas in PPP terms their economy is by far the largest), then this suggests that the conventional wisdom is hopelessly confused by the meaning of “nominal GDP”.

I suppose a skeptic could argue: “I don’t believe in any sort of adjustments for differences in cost of living. Those are done by bureaucrats using arbitrary techniques that are highly subjective. I stick to nominal data at market exchange rates.” Fine, stick to your principles. But in that case, you are forced to believe the US economy grew at 11%/year between 1971 and 1981. Is that what you believe? (BTW, I’ve seen gold bugs insist that only economic data in gold terms is meaningful, which implies that India and China drove us into a deep nominal depression in the 2000s.)

But if you do believe that any meaningful comparison over time or across countries requires an adjustment for differences in the price level, then you shouldn’t go around saying “China is the world’s second largest economy”. That’s nonsense.

PS. Of course China’s population is 4 times larger than the US, so it remains far poorer in per capita terms, closer to Mexican levels. But please don’t respond to this post by saying that total GDP doesn’t matter. I’m simply responding to the hundreds of examples of people calling China the world’s second largest economy. They seem to think that claim matters, at least for some purposes.

PPS. I do believe that most PPP estimates of China’s economy are imperfect, but most likely the error is in underestimating the size of their economy. I’ll cover that issue in a future post.

Scott,

I am not sure if this is entirely correct. It's correct that in itself, GDP denoted in a country's currency doesn't tell you much, *unless* its in relation to another country. For instance, we have an exchange rate between the US and China, which to a limited extent, the Chinese government does allow to float within a band(they actually do this to keep the Yuan up, and from going down). In those terms, the US economy is much bigger than the Chinese economy.

Taking your Zimbabwe example, the NGDP has grown by tremendous numbers, but as your point out, it tells you nothing about Zimbabwe's living standards or Real GDP relative to another country. Let's say that the Zimbabwe NGDP goes up 10x due to hyperinflation, but the ratio of Zimbabwean dollar to USD goes does by less than a factor of 10, we an assume that the value of Zimbabwe's production has gone up. Similarily, if the ratio goes down by more than a factor of 10x, we can assume that the value of Zimbabwe production has gone down.

So, yes it makes sense to report a country's growth in real terms, but also use nominal GDP as a comparison.

Wow, so Russia is the 4th greatest economy, followed by Japan/Germany/Indonesia. Ne-ja-nisnaju, but knowing some prizes and salaries in Moscow and in the provinces, that PPP seems to over-value Russia (resp. the purchasing power of 10.000$ in Austin vs. Irkutsk).