Why money is important

A critique of Tabarrok and Cowen

In a previous post, I referred an Alex Tabarrok and Tyler Cowen discussion of the 1970s inflation, an area where my views are fairly similar. Today I’ll look at their new podcast on the “New Monetary Economics” (which is now pretty old), an area where I have some major disagreements. Indeed, I’ll argue that their discussion mostly misses the point, largely due to confusion over money’s role as a medium of account.

The three economists most associated with the New Monetary Economics were Fischer Black, Eugene Fama, and Robert Hall. I would argue that Earl Thompson was equally important, although perhaps less well known. I also did some work in the NME tradition during the 1980s, including a paper calling for the central bank to peg the price of NGDP futures contracts. Tyler Cowen co-authored a book on the subject with Randall Kroszner.

Unlike Fama and Hall, Fischer Black failed to understand the special role of the medium of account. Under our current system, the monetary base (cash plus bank reserves) is the medium of account. Under the old gold standard, the medium of account was gold, and the US dollar was defined as 1/20.67 ounces of gold. Under that regime, “US dollar” was the unit of account in the United States, pound sterling was the unit of account in Britain, and gold was the medium of account in both countries. However, you could also argue that the US had dual media of account—gold and currency notes—linked by a fixed exchange rate. I wrote an entire book on the subject.

The vast majority of claims that monetary policy is (nominally) unimportant are based on confusion over the role of the medium of account. Let’s review the many ways that people use the term “money”:

Wealth: “Bill Gates has a lot of money”

The money market: Safe, highly liquid short-term debt.

M2: Bank deposits plus cash

Monetary base: Cash plus bank reserves

Monetary skeptics will say, “You can’t even define money.” But you can precisely define the medium of account, which is the monetary base. Then they’ll say “But the monetary base is only a tiny percentage of our vast financial system.” That’s true, but that fact doesn’t have any implications for the effectiveness of monetary policy.

Those who believe that the monetary base must be big in order to have a big effect on the economy may be implicitly taking a Keynesian view of macro. They see monetary policy as a real factor. You stimulate a lot of real activity, and that creates inflation.

Monetarists see monetary policy as a nominal factor. Changes in the supply (and demand) for the medium of account impact the relative price of the medium of account (cash). Inflation is nothing more than a fall in the relative price of the medium of account, a fall in its purchasing power over goods. When prices rise 1%, the purchasing power of a dollar bill falls by 1%. When you see things this way, it immediately becomes apparent that the share of GDP held as base money has no bearing on the effectiveness of monetary policy.

It might be helpful to think of a non-monetary analogy. Consider a commodity that is a sizable share of GDP, say crude oil. Now consider another commodity that is a small share of GDP, say kiwi fruit. Obviously, oil shocks have a bigger impact on GDP than kiwi market shocks, in a real sense. This is probably why people (wrongly) assume that the monetary base’s small share of our financial system is important. In a real sense, big commodities really are far more important than small commodities.

But in a nominal sense, the two commodities are quite similar. A big increase in oil supply will often depress oil prices (depending on demand). But it’s equally true that a big increase in kiwi fruit supply will generally depress kiwi fruit prices. In both cases, the purchasing power of the commodity in question will decline, relative to other goods and services. When the relative price of oil falls sharply, a barrel of oil buys fewer goods and services. The same is true when the relative price of kiwi fruit falls sharply. The laws of supply and demand don’t stop working because a commodity is small.

It doesn’t matter whether the monetary base is 10% of GDP, 1% of GDP, or 0.001% of GDP. The central bank has a monopoly on base money, and by affecting the supply of base money (through open market operations) and the demand for base money (through interest on reserves), it can dramatically impact the relative price of base money, aka the price level of goods and services. What makes money special is that all other goods are priced in terms of money, not in terms of oil or kiwi fruit. So it matters a lot (in a nominal sense) when the value of money falls.

BTW, under the old gold standard, gold stocks were an even smaller share of GDP than currency. So if the monetary base doesn’t matter because it is small, then all the standard models of the gold standard are also wrong.

The Fed now tries to adjust the supply and demand for base money in such a way as to depreciate the dollar bill at roughly 2% a year, on average. Under the 19th century gold standard, the average inflation rate was roughly zero, as the global gold supply rose at approximately the same rate as gold demand. During the 1970s (before inflation targeting), we had high inflation because the supply of base money rose much faster than demand. Since 1992, inflation has averaged about 2%, with a brief but notable overshoot in 2021-22. Coincidence? I don’t think so. The Fed made that happen.

It’s clear that the financial markets agree with me (and Fama and Hall and Thompson) and disagree with Black. Even hints of a modest shift in Fed policy often cause large swings in asset prices.

Even worse, if monetary policy really were ineffective, then it’s not even clear the Fed could control interest rates. Consider two possibilities:

The Fed has no ability to control interest rates.

The Fed can control interest rates, but this doesn’t matter.

Is either one of those the argument that you wish to make?

Some might argue that they can control nominal interest rates, but not real interest rates. But (as we’ll see in a moment) proponents of that view don’t seem to understand its implication. That sort of claim implies that the Fed can control inflation; indeed it implies that inflation moves one for one with nominal interest rate movements engineered by the Fed. That’s basically what people mean by “NeoFisherism”. There’s an even more bizarre form of monetary skepticism, which suggests that the Fed can control both real and nominal interest rates, and yet monetary policy is still ineffective. This view is associated with MMTers.

[As an aside, there is a completely separate sense in which monetary policy might be ineffective. It is possible that in a world of flexible wages and prices, the Fed could control nominal variables, but have no impact on real variables such as output and employment. This extreme “real business cycle” perspective is probably wrong, but even if it were true it has no bearing on Fischer Black’s claim that monetary policy doesn’t even affect nominal variables.]

Part 2: Reply to Tabarrok/Cowen

Monetary skeptics often skip around from one issue to another, and it can be difficult to pin down the exact source of disagreement. For instance, Tabarrok discusses an economy with no money:

The first is I think there’s no role for monetary policy. Well, why not? Well, there’s no money. There’s only financial assets. The Fed in this world, they could sell T-Bills or buy T-Bills, but so what? Selling T-Bills in this world is just swapping one financial asset for another asset. Swapping assets doesn’t change the real structure of the economy. It’s just a financial change, not a real change.

It’s not clear exactly what sort of system is being envisioned. Is there literally no medium of account? Is it a barter economy? There have been a number of papers discussing the possibility of a “moneyless economy”, but on closer inspection those generally do still feature a medium of account, often settlement balances at the central bank. An excellent paper by Bennett McCallum explores some of these issues. From my perspective, that’s not actually a moneyless economy, and monetary policy remains highly effective. In pure barter, there is no money and no monetary policy.

Alex continues:

Now the second important thing about this world is that it actually seems very close to our world. Most of my transactions accounts, the accounts which I can easily spend, they’re actually invested in bonds. Now, it is true when I buy something I don’t literally transfer $100 worth of bonds, instead I sell $100 worth of bonds, I transfer the $100, and then the person on the other end probably takes the $100 and invests it in bonds.

It’s only slightly different from the world that I described. There’s a few transactions into dollars and then dollars into bonds, but mostly we’re just trading bonds.

That “slight difference” is actually all-important. Even if base money is only a tiny percentage of the financial system, changes in the value of base money impact all nominal variables, including nominal GDP. No matter how small the ratio of MB/NGDP, the Fed has almost unlimited control over the value of the dollar and thus NGDP.

Do you think that in our sophisticated financial system, a system in which trillions of dollars of assets are exchanged every day and people on Wall Street care about reducing trading times by microseconds—this is the world in which we routinely swap interest rates, exchange rates, put options, call options, take out options on all kinds of eventualities—in this world, you’re telling me that the power of the Fed, which many people see as tremendous, huge, you’re telling me that the power of the Fed ultimately rests on the fact that people pay for candy bars with cash, or that we trade bonds in three steps instead of one? Put that way, Fischer Black and Fama seemed to be onto something.

Yes, I really think that.

Cowen then corrects Tabarrok, who mischaracterized Fama’s views, but then he mischaracterizes my view:

COWEN: I agree with what you’re saying. I would draw somewhat of a distinction between Black and Fama. Black just thought money didn’t matter. Fama, like actually Scott Sumner still believes today, he thinks or thought in 1980—Sumner still thinks it—that currency was a unique lever that could force the whole system of prices up or down in a simple quantity theory relationship. Like you, I just don’t believe that.

Note that Tabarrok and Cowen aren’t really discussing the New Monetary Economics, which mostly accepts the crucial role of the medium of account; they are discussing the heretical views of Fischer Black. Fama and Hall shared my belief that the monetary base is a “unique lever”.)

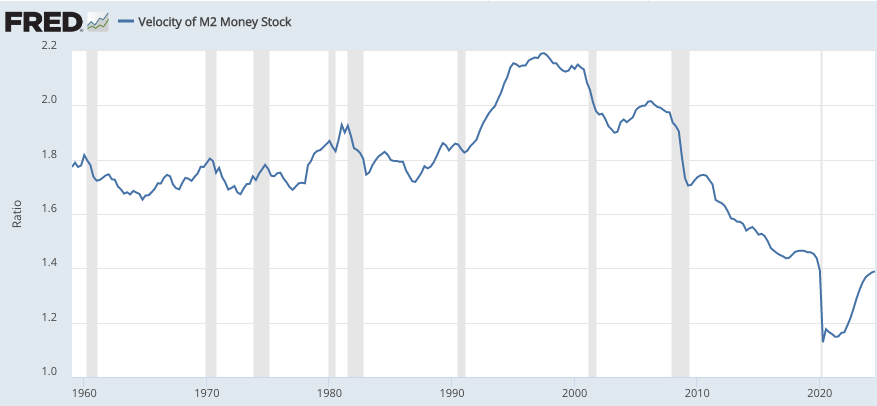

As for the “simple quantity theory relationship”, that’s the view that V is constant and NGDP moves in proportion to M. I don’t know of a single economist that holds that view. I favor adjusting M to offset V, in order to keep NGDP growing along a stable path. Many mainstream economists have recently joined this club, and I wouldn’t describe people like Summers, Romer and Woodford as simple quantity theorists.

[Of course they would say they favored a policy of moving interest rates in such a way that M moved in such a way as to offset movements in V. But if you favor NGDP targeting, you must implicitly favor a stable path of M*V. Right??]

Perhaps Tyler is confused because when I introduce people to monetary economics, I often begin with the simple quantity theory as a sort of intuition pump, before moving on to more realistic models.

Tyler continues:

It would be like saying, “Well, if we doubled the supply of nickels and we used nickels with the price level doubled, maybe some prices would go up where you use spare change,” but it’s not worth arbitraging nickels enough for that to affect the whole economy.

Again, this may reflect Tyler misinterpreting something I said in The Money Illusion. It is true that just dumping lots of nickels on the economy would have little effect. You’d have a surplus (or shortage if you suddenly removed them.) But if you adjust monetary policy in such a way that the equilibrium quantity of coins changes, then the effects would be very large. It’s a subtle distinction, and probably one that many readers missed.

Now my view isn’t the Fed doesn’t matter at all. In my view, liquidity is jointly produced by the private sector and by the Fed, but the Fed matters much less over time. It has a much smaller role in producing the total liquidity of our stocks of wealth and thus total lines of credit.

I see absolutely no evidence for that claim. The base is a far larger share of GDP than in the past. Perhaps you wish to restrict the Fed’s footprint to the currency stock (as reserves are bloated due to IOR). But even currency in circulation is now a larger percentage of GDP (roughly 8%) than it was back when I was born (7% in 1955.) And of course the Fed still has an enormous impact on the broader financial markets.

The Fed can matter at extreme margins if they raised interest rates high enough. Clearly that would matter. There’s different ways they could let the financial system blow itself up, that would matter. At most relevant margins, the private financial sector can offset changes in what the Fed does if it wants to, it may or may not want to, but there’s no simple layer of control.

Interest rates are not monetary policy. It’s true that IOR is one tool of monetary policy, but what actually matters is the supply and demand for base money. To suggest that higher interest rates represent a change in monetary policy is to engage in ”reasoning from a price change.” What matters is not what happens to interest rates; rather what matters is the thing that caused interest rates to change. Rates may rise because of tight money (liquidity effect), or easy money (income and Fisher effects.)

No firm or individual tries to “offset” monetary policy, they try to maximize profits, or maximize utility. Go back to the pre-IOR era, before 2008 (a time when the base was 98% currency), to make things simple. When the Fed did a large exogenous open market purchase that boosted the monetary base by 10%, the public did not try to “offset” that policy. If the public preferred to hold 8% of GDP as currency, they would not engage in the following sort of reasoning:

“Hmmm, I see the Fed increased the base by 10%. They seem to be trying to boost NGDP by 10%. We can all collude to thwart this policy by boosting our preferred currency holdings to 8.8% of GDP, instead of the previous 8% of GDP.”

Why would people do that? Rather, the public would be annoyed at the temporary surge in cash balances, beyond what they normally hold, They would attempt to get rid of the excess cash balances by spending them on goods, services, and financial assets, eventually driving up AD and NGDP.

I suppose that proponents of this offset hypothesis usually have in mind a situation where the public thwarts a tight money policy by issuing close substitutes for Fed money. But if those substitutes were profitable, why weren’t they issued before the tight money policy? In any case, the Fed could take the likely private sector response into account, and figure that a 10% reduction in base money might only reduce spending by say 5% in the short run, as money substitutes filled some of the gap (i.e. reduced the demand for base money.) No one is suggesting that the simple quantity theory applies to the short run dynamics. But this fact doesn’t prevent monetary policy from being effective.

If you look at the data, like Milton Friedman’s monetarism, which is coming of age in the 1960s, well, for the decades before the mid-1960s, the relationship between money and nominal income it was pretty stable. Friedman was right when he wrote it. There’s a reason why he persuaded so many people, but there’s then a series of ongoing, ever more serious blows to the monetarist regularities.

It starts in the 1980s where the relationship between prices and money supply breaks down. You have the 2008 financial crisis, where the Fed increases bank reserves quite a bit, some people expect hyperinflation, hyperinflation doesn’t come. Well, there’s interest paid on reserves. It’s a very complicated story, but most methods of unpacking that story, I think, are going to support the Black view. The money supply is not a simple thing.

I know that’s the standard view. But Friedman usually focused on M2 (which is not my preferred index.) Note that M2 velocity actually was not unusually unstable during the 1980s, apart from a significant (and normal) decline during the severe 1982 recession.

Is the 1980s velocity collapse another one of those apocryphal stories, like the myth that supply shocks created the 1970s inflation? Or the myth that we ran big budget deficits during the 1960s? Or the myth that the subprime fiasco caused the Great Recession? Or the many “bubble” myths? I wonder.

And as far as hyperinflation predictions, if I actually were a simple-minded quantity theorist, I probably would have predicted high inflation after 2008. But of course I’m not, and I didn’t. I predicted below target inflation, which we had.

TABARROK: Right. Yes, it seems very difficult to believe that currency still rules the roost when currency is such a small amount of the money supply and most of the currency is not even in the United States.

COWEN: That’s right, or it’s in the drug trade.

As we’ve seen, currency is actually an increasing share of GDP. A better argument (which Tyler alludes to) is that there is less currency involved in transactions, and more of it is being hoarded.

But for monetary policy, it doesn’t matter where the currency is located. All that matters is the supply and demand for the medium of account. That’s what determines the value of the medium of account, in our case the US dollar. As an analogy, when we were on the gold standard you could envision a system where 90% of gold was used for jewelry and 10% for money, or a system where it was 90% money and 10% jewelry. In either case, changes in the supply and demand for gold determine its value in much the same way.

Again, it’s easier to see this concept using the pre-2008 system, where the monetary base was 98% currency. The price level equals the nominal quantity of base money (which is determined by the Fed) divided by the real demand for base money (determined by the public). That gives the Fed almost unlimited control over the price level, unless they run out of eligible assets to buy.

In the post-2008 system, the correlation between the supply of base money and the price level is far weaker, but the Fed has an additional tool that can also impact the real demand for base money, the rate of interest paid on bank reserves. Between changes in the supply of base money (via QE) and the demand for base money (via IOR) they continue to have unlimited ability to affect the value of money—its purchasing power—and hence all nominal variables.

TABARROK: That totally changes how you have to teach monetary policy, because there’s no money multiplier the way that people used to talk about it. Instead what the Fed did in 2009, they started paying interest on reserves and now, banks had always tried to keep the reserves as low as possible, because you’re not making any interest on your reserves. Now the Fed is paying interest on reserves, so reserves go from billions to literally trillions overnight. The banks are now holding trillions in reserves, which are no different than T-bills, right?

COWEN: Well, monetary policy is fiscal policy. It’s like the Fed has the right to issue something—they would never want to hear it called this—like a little Fed mini T-bill. They create reserves, they pay interest on it. In essence, it’s like a government security, which is backed by the Fed and Treasury as a combined entity. You might think it’s a good thing for the Fed to do, but it literally is fiscal policy.

No, T-bills are not like reserves, because they are not the medium of account. And I don’t think it’s useful to call this “fiscal policy”.

Obviously, any monetary policy has fiscal consequences. That’s always been true. Printing money is profitable, it creates inflation tax revenue. But it is still very useful to discriminate between stimulus actions that are expected to create future tax liabilities (deficit spending), and those that (on average but not always) reduce future tax burdens (money printing.)

Cowen continues:

Fiscal policy can matter, no one denies that, but again, it’s just a very different, very strange world. The other change is it used to be that so much lending was done through the banking system in the United States. Now, by some estimates, banks in the formal sense account for about 20 percent of the lending. If the Fed is operating through banks and that’s 20 percent of the system, why should that be so important? Indeed, probably it isn’t, it still has a role, but banks are likely to continue shrinking in importance.

The Fed doesn’t operate “through the banking system”; it operates by changing nominal aggregates such as GDP using tools like OMOs and IOR. Even if the banking system completely disappeared, the Fed could easily keep prices growing along a 2% path through suitable adjustments in the growth rate of the currency stock (by assumption there would be no bank reserves). It would continue to use open market operations to adjust the currency stock.

COWEN: That’s right, which may be a good thing to do, but it causes you to rethink what’s the Fed, actually? The global money supply, not even a well-defined concept, but there’s something global that does matter, right?

Again, you need to think in terms of the medium of account. Is the global money supply the total of all types of money, or the global supply of one specific asset—US dollars? The latter does matter, the former does not.

COWEN: Timothy Fuerst had a good paper on this I think in 1992. There’s a well-known paper by Kevin Grier, coauthors. They show there’s some effect that the Fed can influence real interest rates, but how hard they had to work to show any effect at all. Now, you have this period, the ZIRP period right after 2008, 2009 where the Fed is by one measure, at least—with apologies to Scott Sumner—extremely expansionary. Even real interest rates seem to be below zero for an extended period of time.

Now, there’s the question of how should we interpret that era? I think the huge mistake is to generalize from that era. People just think the Fed can put real interest rates wherever they want, because the Fed, it seems, gave us negative real rates for a decade, but that, too, was a temporary thing.

Tyler’s right that the Fed has relatively little impact on real interest rates, but of course real interest rates have little or nothing to do with monetary policy. Tyler seems to be suggesting that monetary policy was “extremely expansionary” because of negative real interest rates. (Unless he was referring to QE.)

Here it will be helpful to review why interest rates (both real and nominal) are a horrible indicator of the stance of monetary policy, quite nearly the very worst. Indeed use of interest rates is almost a textbook example of reasoning from a price change.

Let’s start with nominal interest rates. Unless your name is Joan Robinson, you probably don’t wish to argue that hyperinflation in economies like Argentina, Venezuela and Zimbabwe cannot possibly have been caused by monetary policy, as interest rates were not low. In case you don’t know what I’m referring to, here’s AI Overview:

English economist Joan Robinson believed that easy money could not have caused German hyperinflation because interest rates were not particularly low. Robinson was a follower of John Maynard Keynes, who argued that monetary policy could only impact demand by changing interest rates.

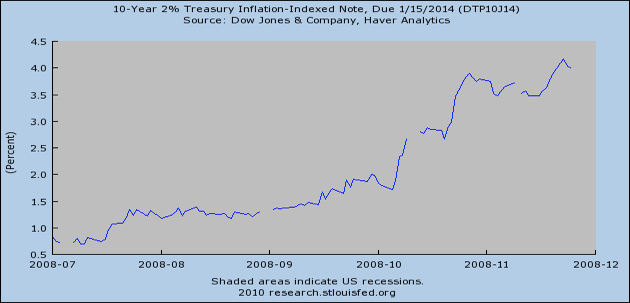

When I make this argument, people often shift to the claim that, “Yes, nominal interest rates are misleading due to inflation, but surely real rates are a good indicator of the stance of monetary policy.” Nope. Real interest rates are flawed for essentially the same reason. Just as swings in expected inflation cause changes in the equilibrium nominal interest rate, swings in GDP growth, investment booms and busts, and financial distress cause big swings in the equilibrium real interest rate.

Ben Bernanke understood that neither nominal nor real rates are a good indicator of the stance of policy:

The imperfect reliability of money growth as an indicator of monetary policy is unfortunate, because we don’t really have anything satisfactory to replace it. As emphasized by Friedman (in his eleventh proposition) and by Allan Meltzer, nominal interest rates are not good indicators of the stance of policy, as a high nominal interest rate can indicate either monetary tightness or ease, depending on the state of inflation expectations. Indeed, confusing low nominal interest rates with monetary ease was the source of major problems in the 1930s, and it has perhaps been a problem in Japan in recent years as well. The real short-term interest rate, another candidate measure of policy stance, is also imperfect, because it mixes monetary and real influences, such as the rate of productivity growth. . . .

Ultimately, it appears, one can check to see if an economy has a stable monetary background only by looking at macroeconomic indicators such as nominal GDP growth and inflation. On this criterion it appears that modern central bankers have taken Milton Friedman’s advice to heart.

I’m pretty sure that Bernanke mentioned NGDP because he immediately recognized that people would object that supply shocks can impact inflation for non-monetary reasons. That’s why NGDP is best, and this indicator suggests that in 2008-09 the Fed gave us the tightest monetary policy since Herbert Hoover was in office. NGDP growth plunged by 8 percentage points.

But let’s say I’m wrong, and that real rates are the correct indicator of the stance of policy. Then why weren’t economists freaking out during the fall of 2008, when real rates on risk free government bonds rose sharply higher? Indeed, why did almost everyone ignore that indicator?

Because they were all focused on sharply falling nominal interest rates.

This was followed by a discussion of cryptocurrencies. These assets are certainly quite interesting, and perhaps increasingly important. But they are not important for monetary policy because cryptocurrencies are not a significant medium of account, at least in the macroeconomically important goods and labor markets. Perhaps at some point in the future they (especially stablecoins) will eat into demand for base money, and the Fed will be forced to respond with open market sales or higher IOR, in order to prevent high inflation. But we are not there yet.

TABARROK: The Modigliani-Miller theorem says—I’m going to give you a philosophical approach first and then we’ll look in more detail—but philosophically it says, “Look beyond the veil of debt and equity to the productive capital underneath.” Ultimately, both the firm’s debt and equity are owned by households, but clearly aggregate household’s consumption is determined not by the labels which we assign to the productive capital, to the earnings of the productive capital, but to the productive capital itself.

Modigliani-Miller was saying that for a firm, it doesn’t matter. The value of the firm does not depend upon whether it has got a lot of debt and a lot of equity, or a lot of equity and a lot of debt. The debt-equity ratio doesn’t matter. They also say that is true for the economy as a whole, debt and equity they’re just names which we put on these different streams which are all coming from the underneath, the capital, the tractors, the buildings, the roads, the human capital. That’s what’s important.

Of course there are real world complications, but I’m willing to accept all of that for the sake of argument. What are the implications for monetary policy? I’d say this model perfectly aligns with the simple quantity theory of money. Under M-M, if you do a 2 for 1 stock split, then each $80 share is replaced with two $40 shares. The number of shares doubles. The aggregate underlying real value of the firm is unchanged, but each share of stock has only half the real value it had before the stock split.

In the simple QTM, if you double the money supply and real GDP is unchanged, then each dollar bill has only half the purchasing power it had before the money supply doubled. It’s no different from replacing a 36-inch yardstick with an 18-inch measuring stick. Each object you measure looks twice as long.

So the M-M approach to finance perfectly aligns with the conventional models of monetary policy, and yet Tabarrok (and Cowen?) draws exactly the opposite conclusion:

TABARROK: Yes. Again, this is another way of coming at the new monetary economics because it says if you apply Modigliani-Miller to the economy as a whole, then the only thing that the Fed is doing is selling you 2 percent milk or whole milk, right?

COWEN: That’s right, and you can remix.

TABARROK: Yes, you can remix.

COWEN: Borrow more, or borrow less.

TABARROK: Right. Again, the real asset is what counts, not how those payment streams are divvied up. What role is there for monetary policy in a Modigliani-Miller world?

Where do they go wrong? Perhaps they are implicitly assuming that the monetary skepticism of people like Fischer Black is about whether monetary policy can affect real variables. No so. Black-style monetary skepticism is about whether central banks can control nominal variables, i.e., the purchasing power of a dollar bill. And just as a corporation can affect the purchasing power of a share of stock by changing the quantity of shares in circulation, a central bank can change the purchasing power of a dollar bill by changing the quantity of dollars in circulation. Of course there may be cases where the simple quantity theory doesn’t apply, notably at the zero lower bound, but that doesn’t have anything to do with Modigliani-Miller, which should also apply to monetary policy during “normal times”, if Alex is correct.

There are two different senses in which monetary policy might not matter. It might not matter in nominal terms, especially if the Fed were swapping base money for another asset that was a perfect substitute. But in that case, open market operations wouldn’t even impact nominal interest rates and the pre-2008 Fed would have had no control over market interest rates. AFAIK, even MMTers don’t believe that!

The other sense in which money might not matter is that it might be neutral, even in the short run. An exogenous X% increase in the money supply might cause all nominal values to immediately rise by X%, leaving all real values unchanged. But that’s clearly not true, due to sticky wages and prices. And that’s not the issue Tabarrok and Cowen examined in their discussion.

If you closely follow the way that financial markets react to policy news, it’s pretty clear that they don’t buy into Black-style monetary skepticism. This was especially true during the interwar period, when policy was far more erratic and the monetary shocks were much bigger and easier to identify. Markets also reject MMTism, and I’d say they reject extreme NeoFisherian claims that higher nominal interest rates represent monetary easing. Markets also reject fiscal theory of the price level claims that fiscal policy determines the path of inflation and monetary policy is ineffective.

Some market reactions are consistent with Keynesian theory, but not all. In my view, market responses to monetary policy shocks are most consistent with market monetarism, but then I would say that, wouldn’t I? :)

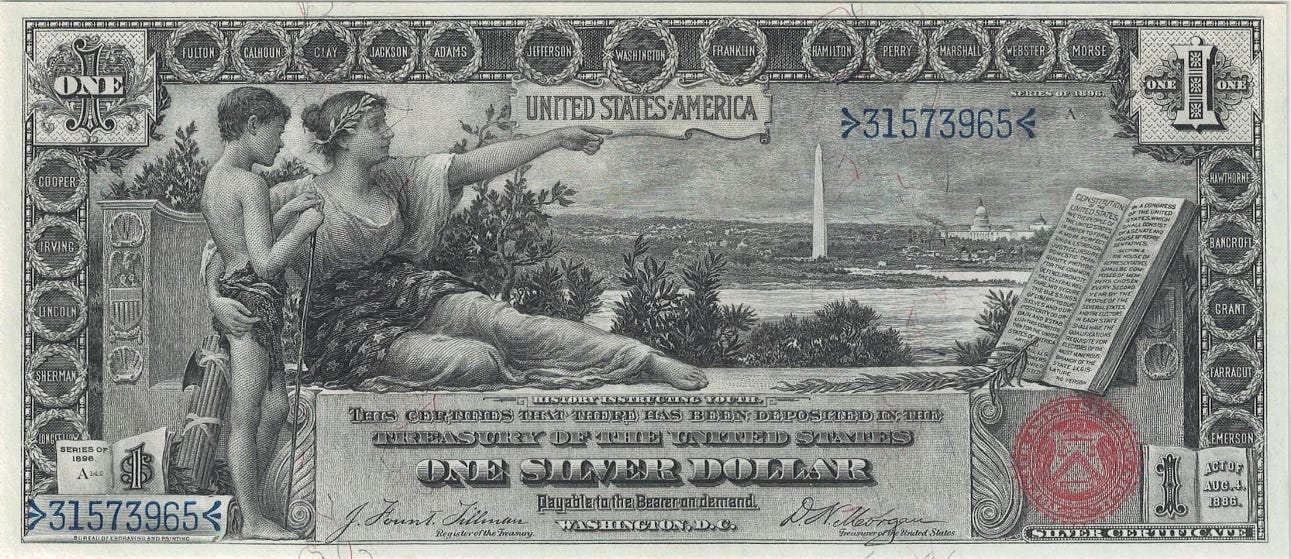

PS. Why are our coins and currency notes becoming increasing ugly?

Everyone, Tyler responded and I left the following comment over at MR. Let me know if you think I misunderstood his point:

#7: "I read Scott as significantly overrating the forecasting power of the nominal in the data."

No, that is misreading me. My post wasn't considering the forecasting power of nominal data. For instance, I don't believe that changes in the money supply are a good way of forecasting inflation.

My post was a critique of the view that central banks cannot control inflation, i.e., the view that they do not affect nominal variables. I was not claiming that they have perfect control over inflation.

I can steer my car, even though I cannot predict where my car will end up 100 yards down the road if I move the steering wheel 1 inch clockwise.

I love the in-depth posts. I remember reading Fischer Black and being strangely torn between his arguments being rather compelling on one hand and seeming obviously false on the other. What you've written helps clarify why.

I'm impressed by your ability to navigate the abstract arguments in this area. Have you written anything about your intellectual biography? Like what kinds of things you read and how they affected you?

Your writing contains a lot of valuable insights spread across many blog posts. Have you considered releasing a book of your best blog posts grouped by subject matter, like Bryan Caplan has done? And/or, as a supplement or follow-up to your book on alternative approaches to monetary policy, you could even think about making a pseudo-textbook that uses your blog posts to supply most of the material, grouping blog posts by their functional material and packaged with short summary essays that use data and references to allow the curious reader to flesh out the essential empirical and theoretical details of the argument.

Your argument as to the hidden role of a medium of account in a "moneyless" economy shows that there are at least some circumstances in which economists are confused as to the abstract character of their own models. Have you ever thought about relating this phenomenon to the challenge of producing models of economics where externalities are present, as per the sort of issues brought up by Carl Dahlman? It's a very different subject to monetary policy, but I'm interested in a potential generalization. Here is Dahlman's paper: https://www.jstor.org/stable/725216