Discover more from The Pursuit of Happiness

Beginning around 2011, I started blogging on the odd fact that America does not have mini-recessions. A mini-recession can be defined in various ways, but I find it useful to view it as a situation where the unemployment rate rises by between 1% and 2%, and then starts falling again. In all recessions for which we have monthly data (i.e., since WWII), the unemployment rate has risen by more than 2 percentage points.

Here in Orange County we are hit with lots of small earthquakes, roughly 4.0 on the Richter scale. But I have yet to experience a big one. That’s true of many phenomena in both nature and human affairs. Small ocean waves are more common than big tsunamis. Individual murders are more common than mass killings. The examples are endless—indeed it’s almost a law of nature. So you’d expect mini-recessions to be much more common than normal recessions, but just the opposite is true. We don’t have any mini-recessions.

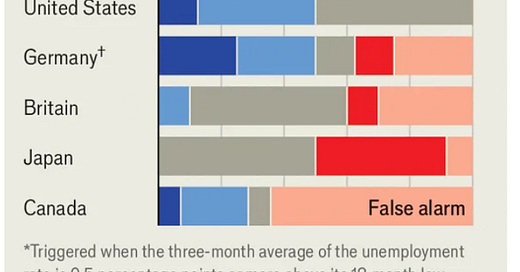

Even more confusing is the fact that other countries do have mini-recessions. In a recent Economist article discussing Sahm’s Rule, the following graph was presented:

You can think of those false alarms as foreign mini-recessions, periods of time where the unemployment rate rose by a significant amount but no recession occurred. Why do we see false alarms in foreign countries, but not the US? And are we about to have the first false alarm ever in the US? Both Claudia Sahm and I think that this is a distinct possibility, despite the fact that her rule (and my observation about no mini-recessions) would seem to argue against it.

We need to explain three facts:

Why no US mini-recessions?

Why are there foreign mini-recessions?

Why does the US seem likely to have a mini-recession?

In the past, I’ve argued that most of the so-called sectoral “shocks” that are widely viewed as causing business cycles do not in fact cause recessions. The US economy is simply too large and diversified for a single shock to matter very much. For instance, I’ve argued that the 2006-07 housing slump did not cause the Great Recession. And consider the fact that if random shocks did cause recessions, then surely you’d expect mini-recessions to be far more common than normal recessions. But they aren’t.

On the other hand, a shock to an important sector of the economy might be relatively more important in a smaller economy, especially one where exports are a much bigger share of GDP than in the US. If so, then it would not be surprising if sectoral shocks in smaller economies occasionally pushed the unemployment rate up enough to trigger Sahm’s Rule, without leading to an economy-wide recession.

If I’m right, then both Sahm’s rule and the lack of mini-recessions is a characteristic of very large and diversified economies. This would explain why the rule applies to the US, but not to smaller economies. But this hypothesis fails to explain why the US has any recessions at all, or why we might be about to avoid one, despite Sahm’s Rule being triggered. If I’m right that sectoral shocks don’t cause US recessions, then what does cause them?

Long-time readers know that I believe US recessions are caused by tight money policies. Occasionally (as in 1982), these policies may be intentional, aimed at bringing down inflation. In most cases, however, they are policy mistakes. But that raises another question—why are big monetary policy mistakes more common than small mistakes?

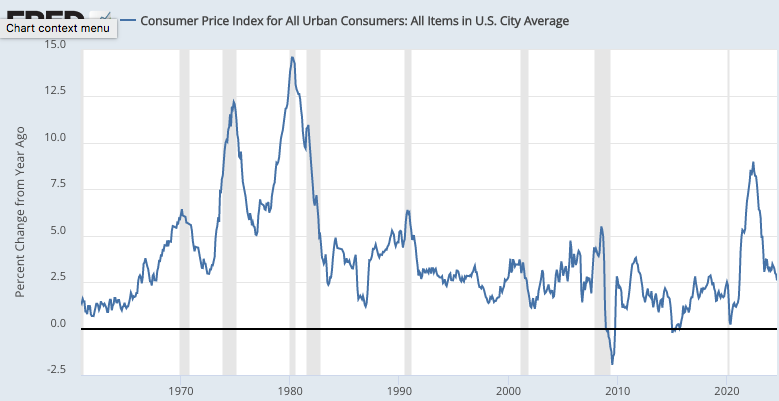

Let’s start with the fact that (excluding Covid), every recession since the 1960s has occurred after a rise in inflation to a level the Fed viewed as unwelcome:

It seems reasonable to assume that the Fed responded to these inflation problems with a tight money policy. But why do they always seem to overreact?

Let’s assume the Fed is doing interest rate targeting. At first, higher rates fail to slow the economy. The Fed thinks this is due to “long and variable lags”, but the actual reason is that money hasn’t yet gotten tight, the target rate lags behind the rising natural interest rate, which is elevated due to high NGDP growth. Inflation continues to worsen.

Eventually the Fed raises rates high enough to slow the economy. At this point, the natural interest rate begins to fall. They Fed remains backward-looking, and for a while the CPI data remains too high. So they don’t immediately respond to the fall in the natural interest rate. This makes money even tighter, the slump becomes more pronounced, and the natural interest rate falls even further.

Finally, the Fed begins to cut rates. But once again, it is behind the curve. The Fed thinks it has switched to an easy money policy, not realizing that its policy rate remains above the fast falling natural rate. The recession gets worse.

If this story is true, how can I explain the fact (if it is a fact), that the Fed seems close to achieving its first soft landing, its first mini-recession? If I am correct, then something in Fed policy must have improved. But what? I’m not sure, but one possibility is that policy has become more forward-looking, more reliant on market indicators.

Consider that the Fed just cut rates by 50 basis points despite:

Inflation still being above the 2% target.

Wage growth still being elevated.

Unemployment being low.

GDPNow forecasting 2.9% real growth in Q3.

To be clear, it is possible that the Fed just made a mistake. Time will tell. But if they succeed, what could we point to beyond just dumb luck?

There are a number of market indicators that directly or indirectly suggest that rate cuts may be appropriate. In my view, the two most important are:

Low 5-year TIPS spreads—indicating low inflation expectations.

Sharply falling rates in the fed funds futures markets.

Put simply, markets are forecasting that the Fed will be able to cut rates sharply without triggering high inflation. Again, the markets may be wrong, but I believe market forecasts are the least bad forecasts available to policymakers. If the Fed succeeds, it may be due to a heavier than usual reliance on market indicators as a guide to monetary policy.

Markets as a guide to policymakers—hmm, where have we heard that before?

Subscribe to The Pursuit of Happiness

Nostalgia for the Neoliberal Era

Off topic but maybe a question other newer readers have too (and might make for a useful blog post): How should a new reader with some basic familiarity with economics and (optionally) your work start to really get into your work?

Is it by reading The Money Illusion (book) and then this blog? Maybe with an additional detour into some of the early Money Illusion (blog) posts you talked about recently? Or are there additional posts or a different orders you'd recommend?

Interesting read here. I too did not expect the Federal Reserve to cut rates by 50 bps for it would appear to be panicking. Yet, that’s what happened.

It does suggest that perhaps the Federal Reserve has learned some lessons from the past. Time will tell.

I should very much like to read your piece on how the Great Recession was not caused by a housing shock. Could you link to it?